Description of the Textbook

Title: Accountancy – Computerised Accounting System (Class 12)

Board/Curriculum: CBSE / NCERT

Medium: English

Overview of the Content

The textbook covers the principles and functioning of a Computerised Accounting System (CAS), emphasizing how computers and accounting software streamline accounting processes for businesses.

Key Topics and Concepts:

-

Introduction to CAS

-

Components of CAS

-

Salient Features of CAS

-

Simplicity & Integration: Merges various business functions—like sales, purchase, inventory, finance—for unified operation.

-

Transparency & Control: Enhances visibility and user access across processes.

-

Accuracy & Speed: Offers fast, error-minimized data entry using templates.

-

Scalability & Reliability: Grows with business needs and ensures secure, dependable data.

-

-

How CAS Software Works

-

One-time setup includes organization profiles, fiscal year setup, and master file creation.

-

Recurring actions include entering transactions using vouchers (cash, bank, purchase, etc.) and generating reports like day books, ledgers, trial balances, profit & loss, balance sheets, and cash flow statements.

-

Security measures like password protection, audit trails, and data vaults ensure confidentiality and regulatory compliance.

-

-

Advantages of CAS

-

Speed, Accuracy, & Real-Time Updates: Reduces manual labor and updates information instantly.

-

Automated Document Generation & MIS Reporting: Offers immediate access to key financial reports.

-

Scalability, Legibility & Storage Efficiency: Handles growing data volumes, maintains clear documentation, and saves space using digital storage.

-

-

Limitations of CAS

-

Rapid Technological Obsolescence: Requires updates to stay current.

-

Risk of Data Loss: Due to power failures or hardware damage.

-

Security and Reliability Issues: Risks due to unauthorized access or inadvertent alterations.

-

-

Accounting Information System (AIS) Subsystems

-

CAS supports multiple functional subsystems such as:

-

Cash & Bank, Sales & Receivables, Inventory, Purchases & Payables

-

Payroll, Fixed Assets, Expense, Tax, Final Accounts, Costing, Budgeting, and MIS.

-

-

Additional Info & Features

-

The textbook adheres strictly to the CBSE/NCERT curriculum for the current academic year.

-

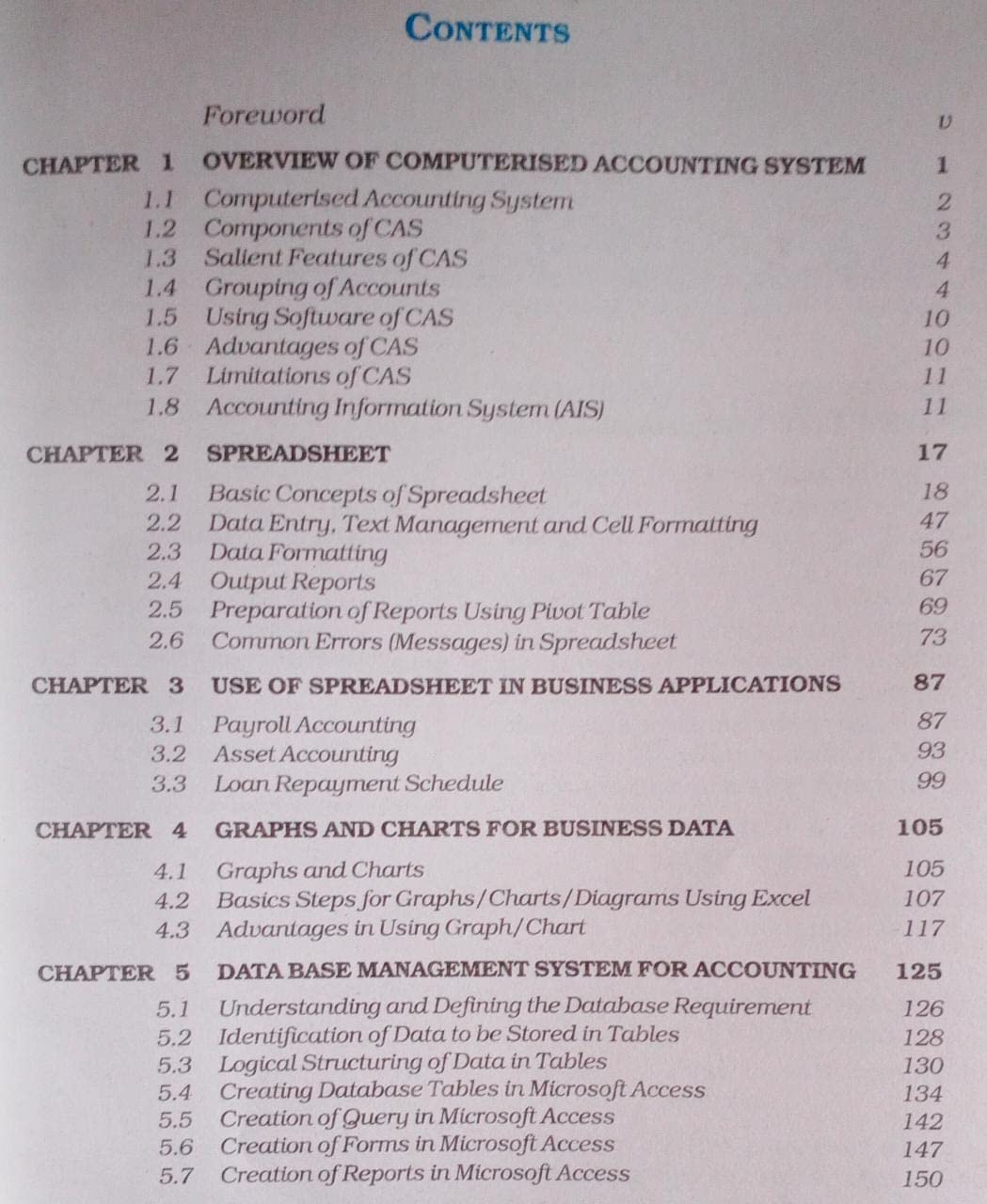

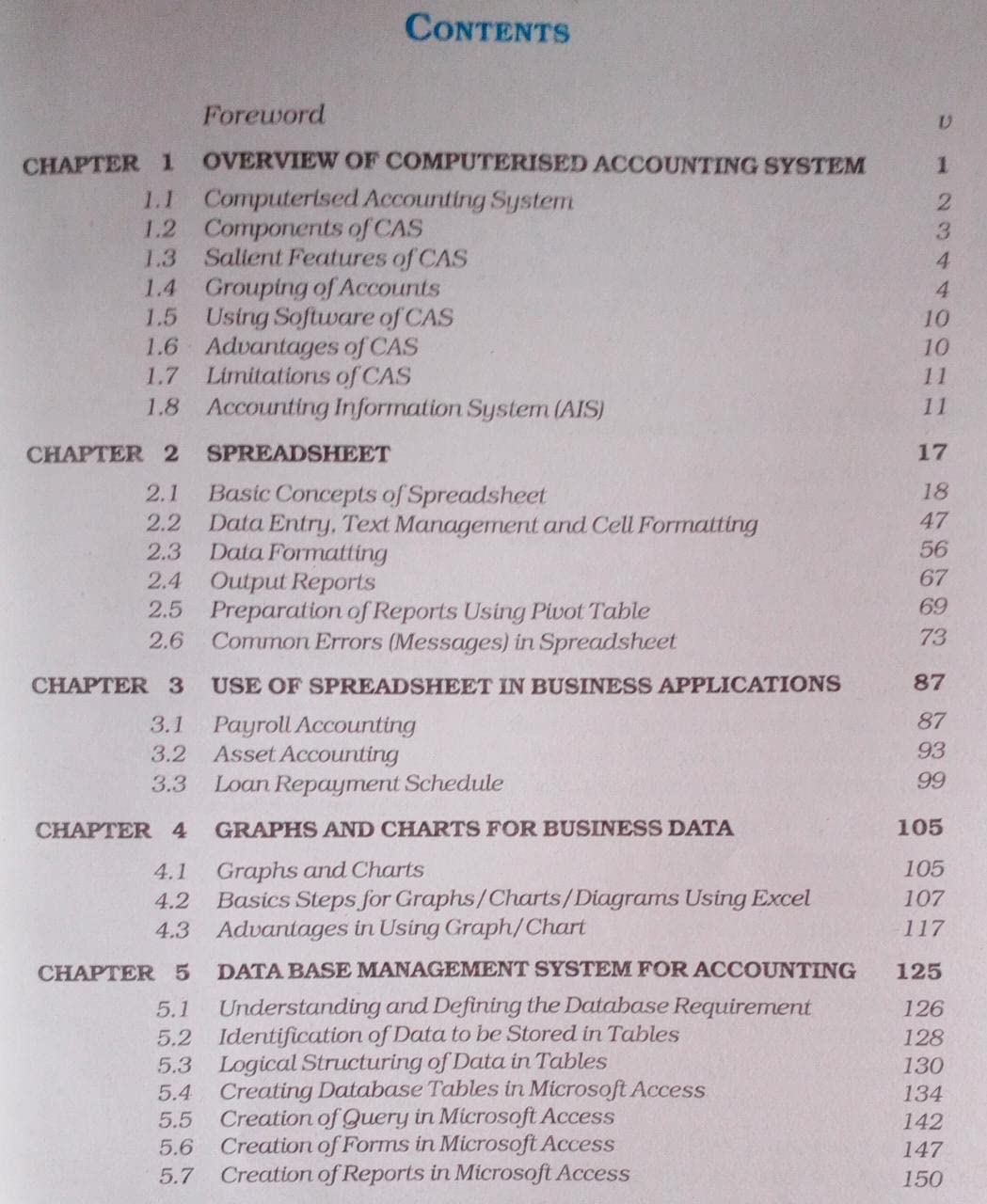

Chapters include:

-

Overview of Computerised Accounting System

-

Spreadsheet

-

Use of Spreadsheet in Business Applications

-

Graphs and Charts for Business Data

-

Database Management System for Accounting

-